Digital fraud

Understand digital fraud

Identity Theft

Identity theft occurs when your ID or passport is stolen or when a false ID is created with your personal information through phishing or from social media sites. The aim is to get credit or loans using your information and pretending to be you.

Read moreWhat is a

phishing attack?

This is a form of fraud where criminals attempt to access your confidential information. This is done either by an email request for information or by leading you to a fake website.

Safety tipsRemote access

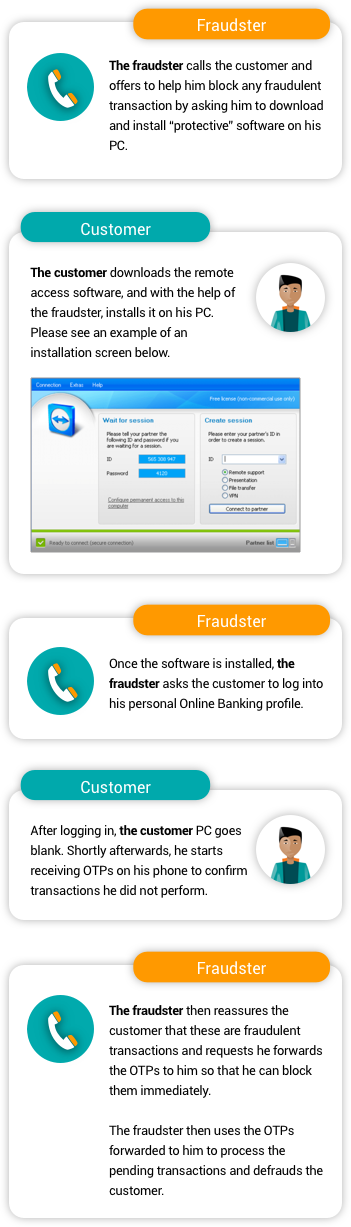

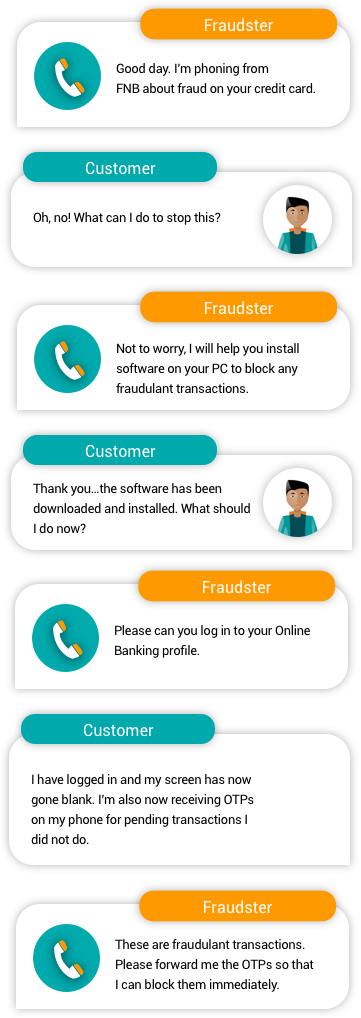

What is Remote Access?

Remote access software is becoming a very popular way for fraudsters to gain access to your banking profile.

Safety tipsSIM swap & porting

A SIM swap is a process of replacing your existing SIM card with a new SIM card moving your existing cellphone number to the new SIM card to receive One Time PIN (OTP) notifications.

Safety tipsWhat is vishing?

Vishing is similar to phishing, but instead of being taken to a fake website via an email, you receive a call where the individual pretends to be from the bank and gets you to reveal personal information such as your username, password and PIN.

Safety tipsWhat is smishing?

This is phishing through the use of an SMS, whereby you are encouraged to disclose personal information. The fraudster will pretend that the message is from a bank and it will prompt you to select a link.

FNB will never ask for your login details (i.e. username and password) via email, SMS, telephone or any other channels.

Lost/stolen device

If your device gets lost or stolen, please call the FNB Fraud Centre immediately to report the incident. You are also advised to delink your device via your Online Banking profile:

Log in to your profile, select 'Online Banking Settings', next, select the 'Banking' tab and then 'My Devices and Browsers'.