FNB Umbrella Pension

and Provident Funds

Provide for your

employees with

an umbrella fund

solution

Our product

As your trusted financial partner, FNB helps you select the best option for your business.

Investment Strategy

The Funds' primary aim is to protect and grow contributions to best enable members to meet their needs in retirement. The Funds offer a wide variety of investment portfolios, designed to meet the diverse needs of participating employers and their employees.

The Funds have a Trustee-choice Default Portfolio ('the default') and they also offer members investment choice, depending on the option selected by the employer. If the employer selected the Bundled Option, members can only be invested in the default, however if members are in the Flexible Option, they will have additional investments to choose from.

MarketStage

At FNB, we have developed a new MarketStage pre-retirement default option which is an investment strategy that considers not only a member's remaining term to retirement but also the prevailing market conditions and environment.

Get the support you need

Funeral cover

We pay a lump-sum benefit in the unfortunate event of the death of your employee, to their nominated beneficiary.

Read More

Disability cover

We offer your employees cover if they become permanently occupationally disabled and are unable to work.

Read More

Critical illness cover

We pay out a lump-sum amount to your employee if they suffer from one of the specified illnesses or conditions.

Read MoreMeet the Board of Trustees

The FNB Umbrella Funds will be managed by a team of reputable industry

professionals that will guide and advise the fund every step of the way.

Why choose the FNB Umbrella Funds

Our FNB Financial Advisors will analyse your business requirements and customise solutions that help you to provide savings benefits for your employees and their families.

*eBucks terms, conditions and rules apply.

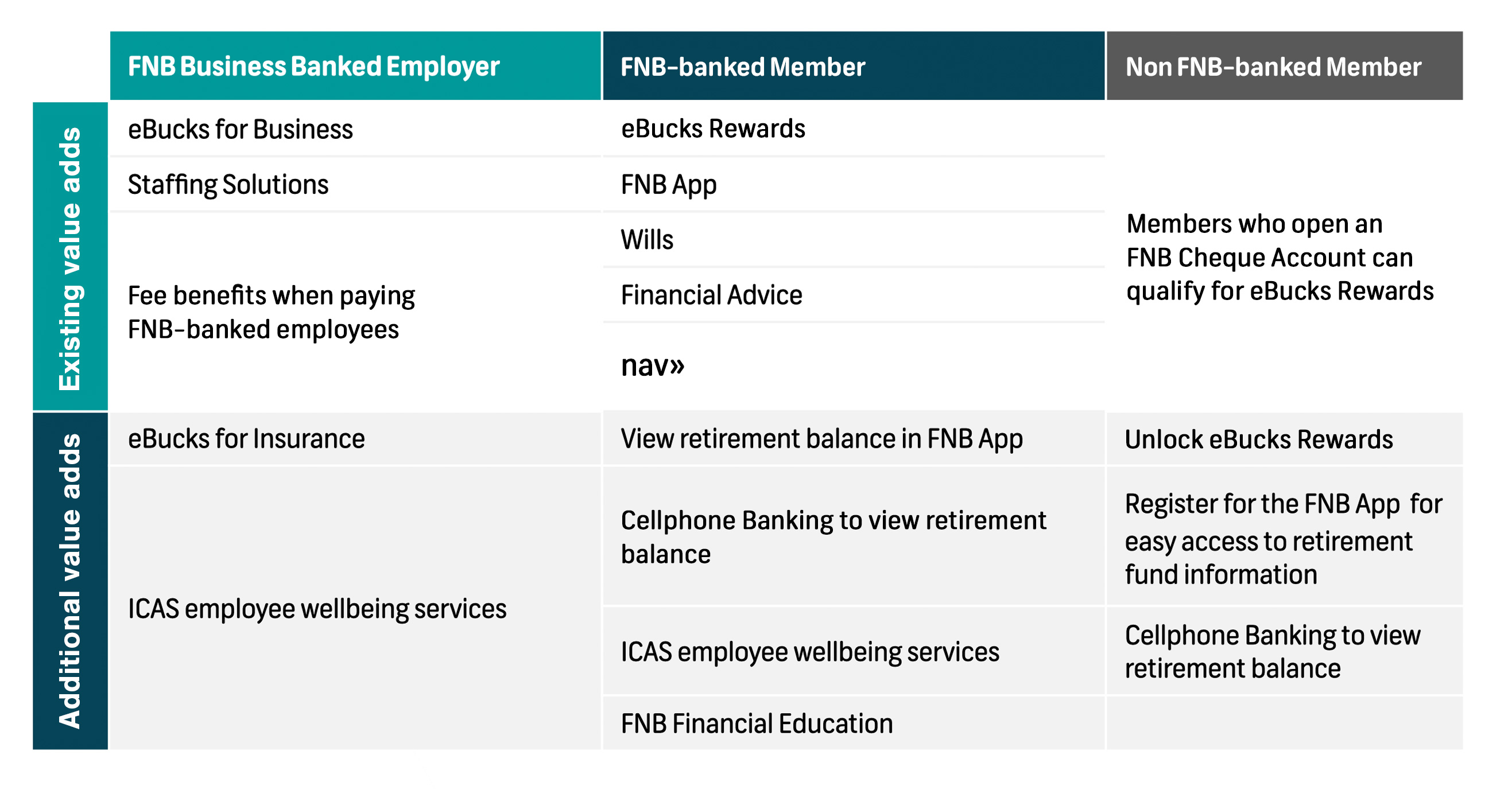

Get rewarded for protecting your employees

As an employer you get even more value from taking care of your employees. You can get a percentage of your annual Group Funeral premium back in eBucks.

Employees with a qualifying FNB account can get eBucks points every month for saving towards retirement.

eBucks terms, conditions and rules apply.

Your eBucks reward level will determine the percentage back in premiums.